Print version

Ways to pay Council rates

It's important to pay your rates on time. If payment is not received by the due date, interest will accrue daily.

Pay online

Pay rates online via credit card

Pay rates online via direct debit

Pay with BPAY

Please note, credit card payments through BPAY are not available. All other BPAY payment methods are available.

Pay with BPOINT

Make sure you have your BPOINT reference numbers from your rates notice, and then call: 1300 276 468 (1300 BPOINT).

Post Billpay

Take your notice to any Post Office which will issue you with a receipt. You can pay with cash, cheque or eftpos.

Mail payment

Please refer to your rates notice for details on how to pay by mail.

Customer Service Centre

Council cashiers are available from 9am to 5pm Monday to Friday to receive payments. You can make payments with cash, cheque, debit or credit card (Visa and MasterCard).

Card service fee

Please note, there is a 1.5 percent service fee, inclusive of GST, on transactions using Visa and MasterCard (credit, debit and prepaid).

If you are having trouble paying your rates for any reason, please contact customer service.

Contact Council

Our Customer Service Centre operates from 9am to 5pm. Our Council Rangers are on duty and contactable seven days a week from 5.30am to midnight.

Address:How to read your rate notice

View our factsheets to see each section of your rate notice explained.

Your rate notice includes the following sections:

Address

Update your address if it has changed.

Assessment no.

Quote your assessment number when making enquiries and payments.

Due date

Date that the full amount (or first quarterly instalment amount) is due.

Issue date (posting date)

Date that the rate notice is sent to ratepayer. Deduct any payments made since this date.

Particulars of rates and charges

- Rates: Depending on your rating category, your rates will appear here. Ordinary rates are calculated on the land value of a property, multiplied by the ‘rate in the dollar’ and subject to a minimum amount.

- Charges: A detailed breakdown of charges including environment, infrastructure and stormwater, any outstanding balances carried forward, applicable pensioner rebates and credits.

Rating category: Residential Rate or Business Rate

Your rating category is displayed here. Most properties in North Sydney are either Business or Residential.

Overdue

If overdue pay now – penalties apply daily.

Interest

Interest rate (set by NSW Government) applied to rates and charges not paid by due date.

Four payments

You can choose to pay rates and charges by instalments. A reminder notice will be issued before each due date.

One full payment

Pay your annual rates and charges in full to avoid missing a payment.

Direct debit

Set up direct debit.

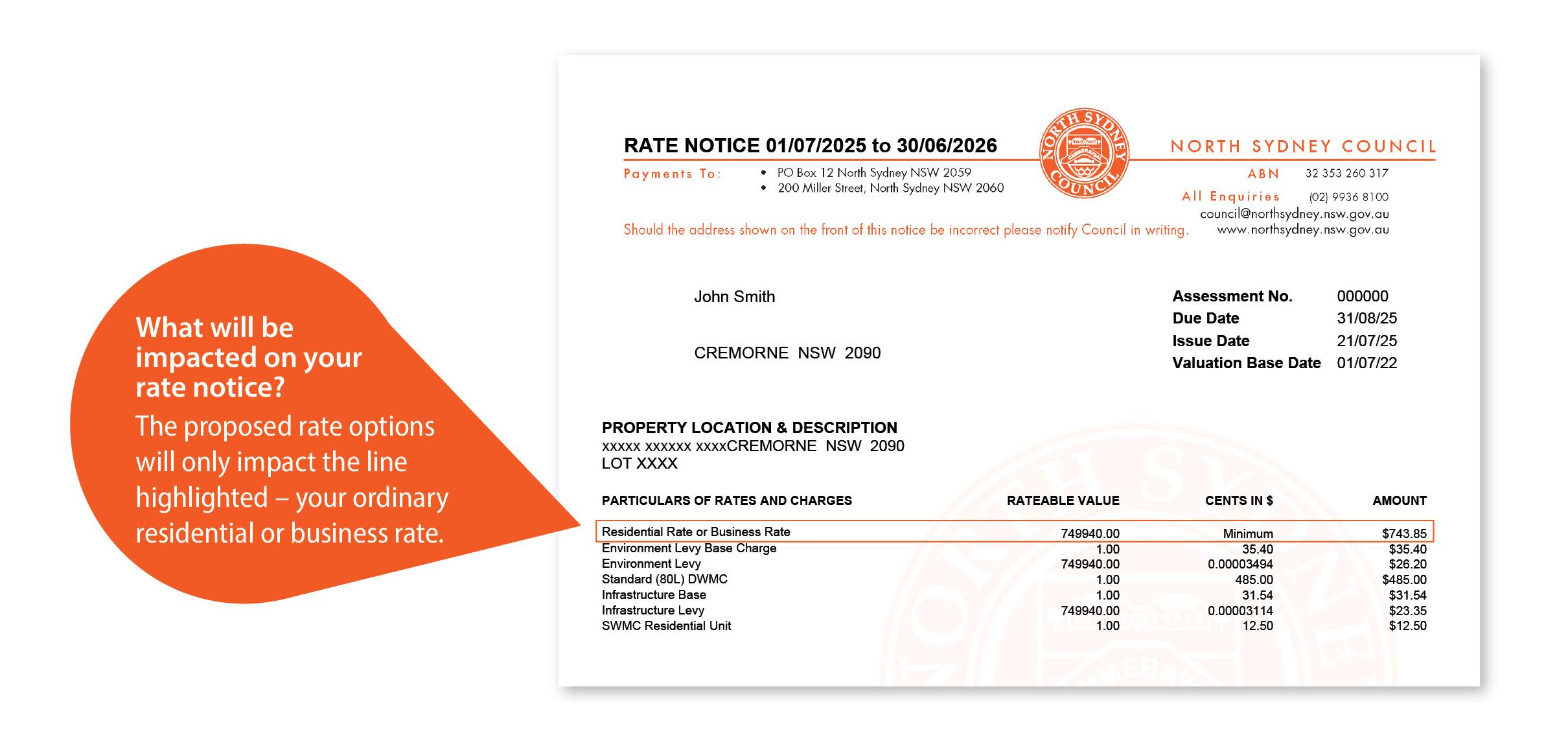

Proposed special rate variation

The proposed rate options will only impact the line highlighted – your ordinary residential or business rate.

Change your land category or details on a rates notice

Change of name

To add or delete a name on a Council rates notice, you must first change your title deeds with the NSW Land Registry Services.

You can then use the form below to notify Council of the change.

Change of address or email

You will need to advise Council of a change of address or email by writing to the below address, or by completing the online form.

North Sydney Council,

PO Box 12,

North Sydney NSW 2059

Notify of a Change of Customer Details form

Change of land category

Categories are important, because rates differ depending on the category of the land. For example, land categorised as residential may attract a lower rate per dollar of land value than land categorised as business. When a property is a mix of residential and business use, a Mixed Development Apportionment factor may apply.

Pensioner Concession

Eligible pensioners may receive up to $250 off their combined ordinary council rates and domestic waste management charges, in accordance with Section 575 of the Local Government Act.

In addition to this statutory rebate, Council also provides a voluntary rebate of up to $242, for the domestic waste management charge.

Eligibility criteria

To qualify for a pensioner rebate, you must:

- Hold a valid concession card - either a Pensioner Concession Card from Centrelink or a Department of Veterans' Affairs card.

- Be listed as the property owner - your name on the concession card must match the name on the property title (as per the Land Titles Office).

- Live at the property - it must be your main place of residence.

- Provide proof of eligibility - such as your concession card and property details.

- Receive a partial rebate if your status changes - if you become or stop being eligible during the year, your rebate will be adjusted based on the number of full quarters you were eligible.

How to apply

Complete the following form and return to Council to apply for a Pensioner Concession Rates Rebate.

Pensioner Concession Rates Rebate application form

Financial Hardship

If you are experiencing financial hardship and are unable to pay your rates on time, you can apply for hardship assistance, and we can provide a personalised payment plan to help you get back on track.

Complete the following form to apply for financial hardship assistance.

Read our Financial Hardship Policy.