How to read your rate notice

View our factsheets to see each section of your rate notice explained.

Your rate notice includes the following sections:

Address

Update your address if it has changed.

Assessment no.

Quote your assessment number when making enquiries and payments.

Due date

Date that the full amount (or first quarterly instalment amount) is due.

Issue date (posting date)

Date that the rate notice is sent to ratepayer. Deduct any payments made since this date.

Particulars of rates and charges

- Rates: Depending on your rating category, your rates will appear here. Ordinary rates are calculated on the land value of a property, multiplied by the ‘rate in the dollar’ and subject to a minimum amount.

- Charges: A detailed breakdown of charges including environment, infrastructure and stormwater, any outstanding balances carried forward, applicable pensioner rebates and credits.

Rating category: Residential Rate or Business Rate

Your rating category is displayed here. Most properties in North Sydney are either Business or Residential.

Overdue

If overdue pay now – penalties apply daily.

Interest

Interest rate (set by NSW Government) applied to rates and charges not paid by due date.

Four payments

You can choose to pay rates and charges by instalments. A reminder notice will be issued before each due date.

One full payment

Pay your annual rates and charges in full to avoid missing a payment.

Direct debit

Set up direct debit.

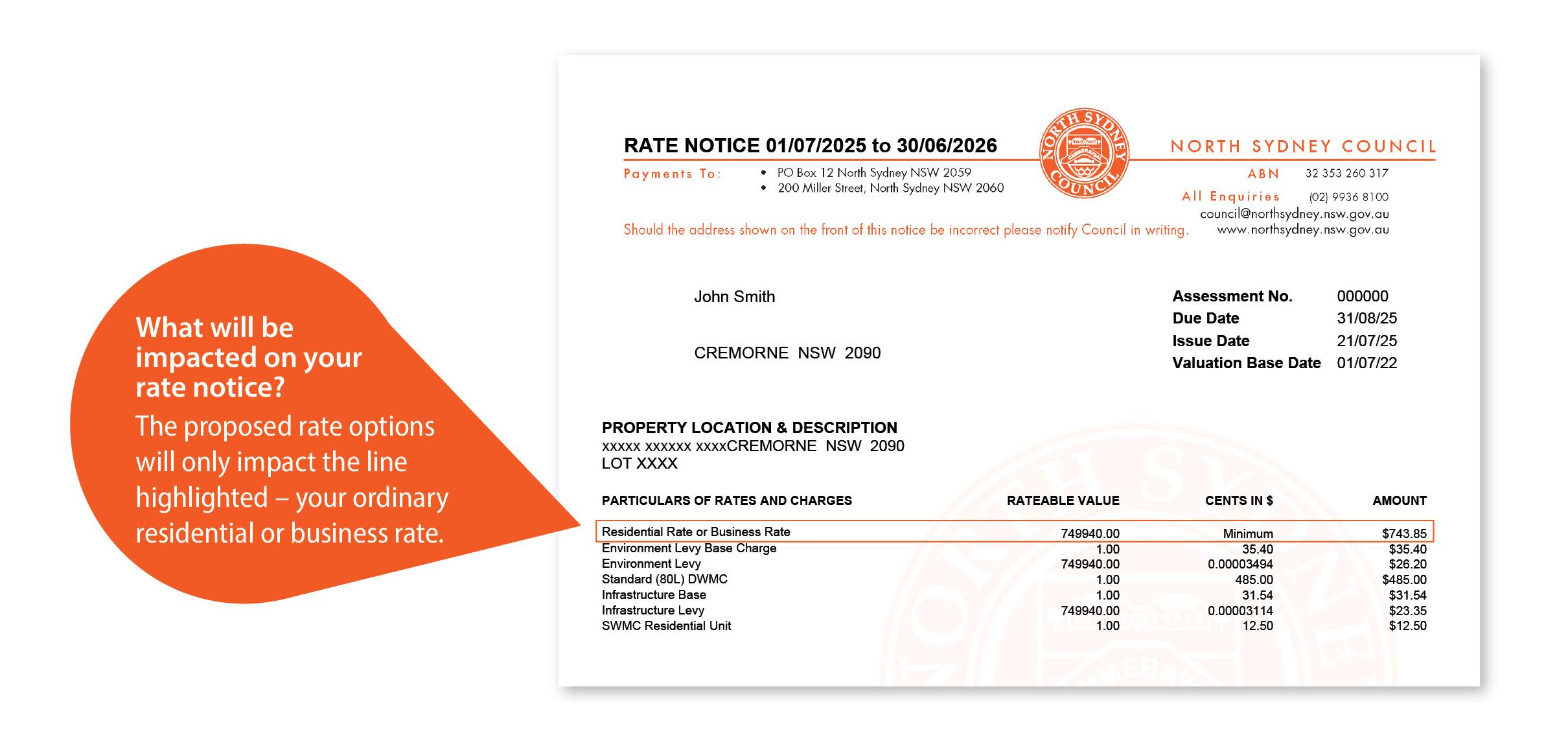

Proposed special rate variation

The proposed rate options will only impact the line highlighted – your ordinary residential or business rate.

Change of land category

Categories are important, because rates differ depending on the category of the land. For example, land categorised as residential may attract a lower rate per dollar of land value than land categorised as business. When a property is a mix of residential and business use, a Mixed Development Apportionment factor may apply.

Complete the printable form below and submit to Council either by post or email to council@northsydney.nsw.gov.au .The ratepayer must notify Council within 30 days when a land category changes from one category to another. If your application has been declined, please discuss with Council as there may be further information required to determine the correct category. If you are still dissatisfied with Council's declaration of the category of your land after it has been reviewed, you may appeal to the Land and Environment Court within 30 days after the declaration was made.