How your rates support North Sydney

Have your say

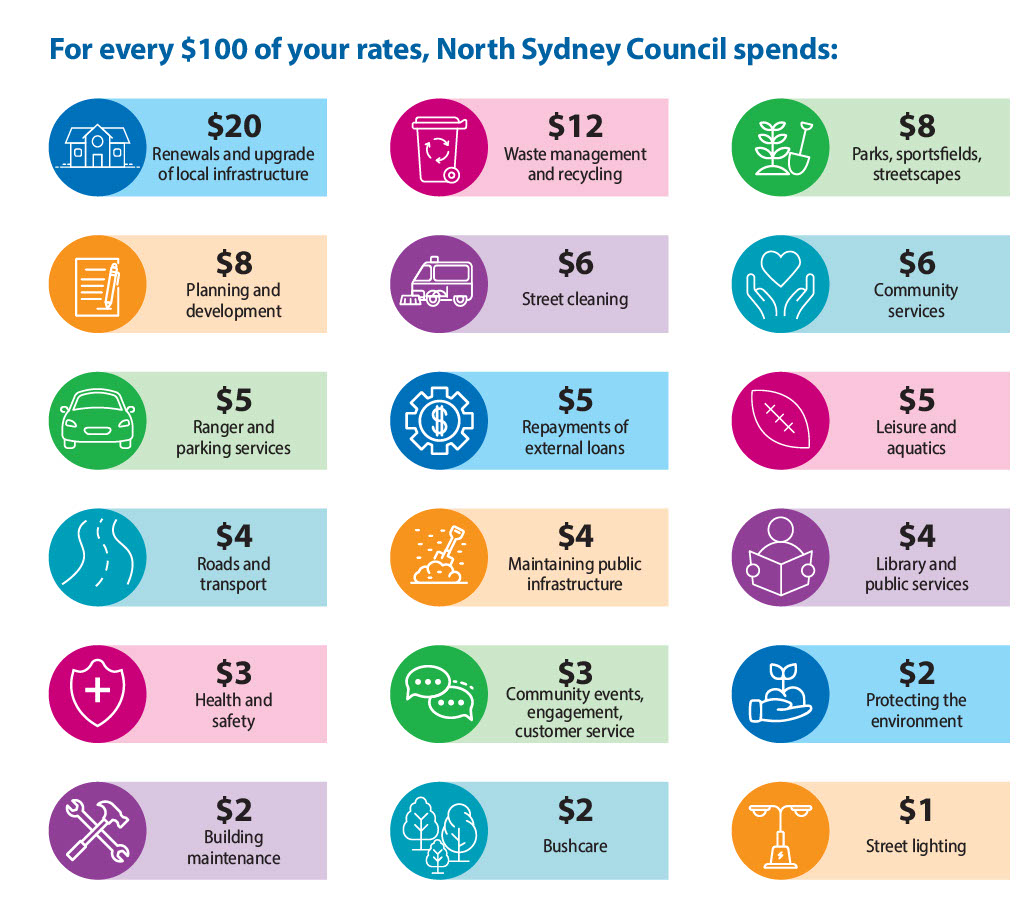

Your Council rates help fund the services and spaces that make North Sydney a great place to live and work. They support everything from waste collection and road maintenance to parks, libraries, community centres, and environmental protection.

If you own a property you are required to pay Council rates, unless your property is exempt (such as a church, school, or hospital). Rates are set under the Local Government Act 1993.

Rate notices are sent out in late July. You can pay in full by 31 August or in quarterly instalments due 31 August, 30 November, 28 February, and 31 May.

Rates make up around 40% of Council’s income and go directly into maintaining and improving essential infrastructure and services across our community.

Your rates: what to know and how to pay

Ways to pay

Find flexible ways to pay your rates: online credit card payment, BPAY, set up Direct Debit, Aust Post or in person

Online rates portal

View your annual rates notices for the past 5 years and receive notices by email

Rates enquiry or reprint

Submit questions, change your postal address request a reprint or refund, and get a copy of your Annual Rates Notice.

Check outstanding Council rates on a property

If you are buying or selling properties submit a section 603 certificate here

Pensioner Concession

Apply for a Pensioner Concession Rates Rebate

Financial Hardship

If are unable to pay your rates on time, you can apply for hardship assistance

How to read your rates notice

View an explainer on how to read your rates notice

Set up or change direct debit for rates

View how you can set up or change an existing direct debit to pay your rates.

Rates overview

- How are my rates calculated?

North Sydney Council charges ordinary rates, along with an environment levy and an infrastructure levy.

The ordinary rates are based on the value of your land, as determined by the NSW Valuer General. Each property’s land value is multiplied by a rate (called an ad valorem rate) set by Council.

To make sure everyone contributes fairly to the cost of providing community services, a minimum rate applies. This means if the calculation based on your land value results in a smaller amount, the minimum rate is charged instead.

The Environmental and Infrastructure levies are calculated using a standard (base) amount plus an ad valorem component, which is based on the value of the land. This approach ensures that all ratepayers make a consistent base contribution while also paying a portion that reflects their property’s value, helping to share costs fairly across the community.

Alongside ordinary rates and levies, you may also see domestic waste and stormwater management charges on your rates notice.

- What is an Ordinary Rate and how is it different from the Infrastructure and Environmental Levies?

Ordinary rates fund general Council services such as parks, libraries, community programs, and roads. They apply to both residential and business properties and are distinct from Infrastructure and Environmental levies.

Infrastructure and Environmental levies are different from ordinary rates because they are dedicated to specific purposes rather than general community services.

The Infrastructure Levy is used to fund the renewal and improvement of community assets like roads, footpaths, playgrounds and public buildings, while the Environmental Levy supports projects that protect and enhance North Sydney’s natural environment, including bushland restoration and sustainability initiatives.

In other words, ordinary rates fund day-to-day Council operations, whereas levies provide targeted funding for important long-term infrastructure and environmental outcomes.

- What is a minimum rate?

A minimum rate is a fixed amount that must be paid by all ratepayers, regardless of their land value. It is the lowest rate that can be charged to a property owner. Properties with land values below a certain threshold are charged this minimum instead of the calculated ordinary rate.

In North Sydney 77% of residential ratepayers pay the minimum rate. This is because minimum rates typically apply to high-rise apartments, where numerous apartments share the one block of land.

Residents living in standalone houses, townhouses, etc tend to pay more than the minimum rate because ordinary rates are calculated using the unimproved land value of a property. Standalone homes and townhouses typically occupy larger parcels of land compared to apartments, resulting in higher valuations and therefore higher rates.

- What does Ad Valorem rates mean?

Ad Valorem is the variable portion of the ordinary rate and is calculated as:

Unimproved land value x rate in the dollar

The land value is set every three years by the NSW Valuer General.

The rate in the dollar is determined by North Sydney Council and varies by land category (residential / business etc). Even if land values in a council area rise significantly, the total amount of money the council can collect from rates does not automatically increase. Instead, councils must adjust the rate in the dollar downward to stay within the rate peg.

The ad valorem rate component simply ensures that those with higher value land contribute proportionately more to council’s revenue. It does not impact council’s overall income.

- How does my land value affect my council rates?

Your land value is determined by the NSW Valuer General, who issues a Notice of Valuation at least every three years. Watch How your land value affects your council rates watch the explainer video and visit Why land is valued and what it's used for | NSW Government for more information.

- What is the rate peg?

The NSW Independent Pricing and Regulatory Tribunal (IPART) limits the amount by which councils can increase ordinary rates from one year to the next. This is known as the rate peg.

Rate pegging has been in place in NSW since the late 1970s. Historically, the annual rate peg has been lower than the actual increase in the cost of providing council services. The rate peg applies to council's overall rate income, not individual ratepayer bills which can change based on property valuations.

The current rate peg for North Sydney Council is 4%.

- What is the infrastructure levy?

Council collects an annual Infrastructure Levy, which on average charges around $63 per annum, per assessment. The levy consists of a base amount (50%) and an ad valorem component (based on land value). Funds raised through this levy must be used for infrastructure renewal and maintenance projects.

- What is the environmental levy?

Council collects an Environmental Levy, which on average charges around $71 per annum per assessment, consisting of a base amount (50%) and an ad valorem component (based on land value). Funds raised through this levy are restricted for use on environmental projects, such as Council’s bushland rehabilitation and sustainability programs.

- What is the Stormwater Management Service Charge (SWMC)?

Council introduced the SWMC in 2014 to help fund the management and maintenance of over 95km of pipes, many of which were installed in the early 1900s.

All residential and business ratepayers pay a small annual fee that helps Council to maintain stormwater drains, reduce flooding, and protect water quality.

The charge is capped under NSW legislation and only provides a tiny percentage of the actual cost required to maintain and renew stormwater infrastructure.

In 2025 the charge was between $5.00 and $25.00 depending on the category of your property for rating purposes.

For the category details refer to Council’s Revenue Policy.

- What is the Domestic Waste Management Charge (DWMC)?

The DWMC funds Council's waste and recycling service (red and yellow bins and free clean-up services).

The Standard (80 L) Domestic Waste Management Charge (DWMC) at North Sydney Council is $485.00 (for the 2025/26 year) for properties using the 80 L general waste bin. Pensioners pay 50% of the DWMC.

Included in the standard DWMC:

1 x 80-litre general waste bin with red lid (unit blocks can combine their waste to get a 240-litre red-lid bin to accommodate 3 units)

1 x 140-litre recycling bin with yellow lid

fortnightly pre-booked collection of garden (green) waste

fortnightly pre-booked collection of household bulky waste.

Not included in the DWMC:

green waste bin – purchase via online form

excess waste sized bins – 120-litre and 240-litre must be purchased by residents.

This year's base rates

The following rates are applicable from 1 July 2025 to 30 June 2026.

| Ordinary rate | ||

|---|---|---|

| Residential properties | minimum base amount – $743.85 | Ad Valorem cents in the dollar – $0.00063794 |

| Business properties | minimum base amount – $743.85 | Ad Valorem cents in the dollar – $0.00461779 |

| Infrastructure Levy | ||

|---|---|---|

| All rateable properties | minimum base amount (50%) – $31.54 | Ad Valorem cents in the dollar – $0.00003114 |

| Environmental Levy | ||

|---|---|---|

| All rateable properties | minimum base amount (50%) – $35.40 | Ad Valorem cents in the dollar – $0.00003494 |

The above rates figures include the rate peg of 4% as determined by the Independent Pricing and Regulatory Tribunal.

Where do your rates go?